What top challenges are accelerating rapid change in the U.S. business environment? Let’s take a closer look at staffing and retaining talent, inflation and recession concerns; Environmental, Social, and Governance (ESG) issues; supply chain, and cybersecurity risk.

Staffing & Retaining Talent

Since late 2021, the economy has experienced the initial onslaught of the Great Resignation and a rise to something never heard before called quiet quitting. The rate of resignations and turnover increased rapidly and had a very near-term impact on business survival. As a result of insufficient staffing, companies have changed hours of operation, extended customer service wait times, and reduced or changed service and product offerings.

The longer-term impacts of talent turnover include the time and cost of onboarding and training new employees as well as maintaining and reinforcing the company’s culture consistently. There appears to be consistency across all industries that leaders feel the business and morale impacts of employee resignations.

Some strategies being used to retain talent have included higher priorities on leadership education and management development programs, learning and development for all staff, ensuring a work/life balance, hiring contract workers during peak workloads, making timely market adjustments, and communicating often with employees.

In a recent study with 25,000 Americans polled, nearly 90% of the people surveyed said, if offered, they would accept a flexible work option. There is a lot that goes along with flexible work options. To hire top talent, leaders are leaving the flexibility up to the candidate. In many cases, it’s whatever they want to do. Flexibility works best when people are doing their jobs well. Our talent at LBMC has the autonomy to do what they would like to do if job responsibilities are managed well. In our company, about 80% of our workforce has a hybrid arrangement. If the work is getting done and everyone is progressing in their careers, the long-term outlook is good.

Life has changed and that’s okay. Businesses have to change too. The fact is that remote and hybrid jobs are consistently being filled more rapidly. This has been more challenging for leaders in the manufacturing and distribution sector, transportation sector and the healthcare sector because they don’t have as many remote and hybrid work options.

It’s been said that people don’t leave a bad job; they leave a bad boss. While that could have been the case in the past, some of the more current factors for turnover include lack of communication from leadership, lack of growth and development options, work/life imbalance, below market salaries and lack of flexibility.

It’s not just about more money or an occasional catered lunch; it is how you sequence all of that together to build relationships that may have happened more naturally in a pre-COVID world.

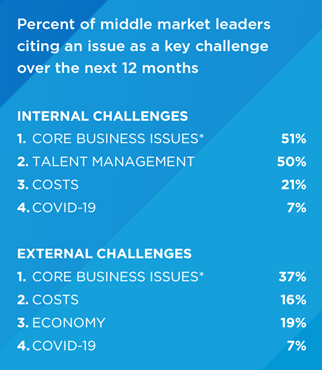

We recently asked a group of business leaders, “What has been your biggest challenge in the past 18 months?” Thirty-seven percent (37%) responded “finding talent” while another 37% said they were struggling with all areas of finding and retaining talent and keeping up with client demands due to lack of talent. With more than half of leaders struggling with staffing issues, it is worth being strategic.

Try including your talent in corporate communications on operational or productivity issues you are having. Ask them how they would solve them with you. Among young professionals, you may find many innovative ideas for your recruiting and retention challenges, too. What is best for someone who entered the workforce 25 years ago is completely different from the needs of the new generation of workers.

Inflation and Recession

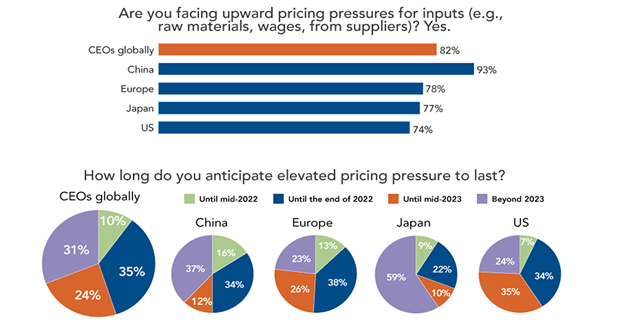

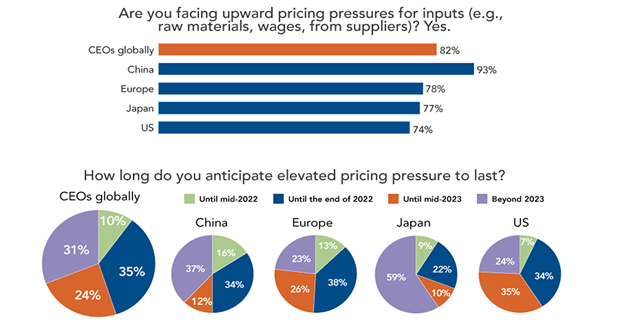

In a recent Conference Board survey, 82% of CEOs globally reported facing upward pricing pressures from raw materials, wages and other products from suppliers. Just over half of CEOs expect the current inflationary environment to last into 2023 and beyond. To cope with these pressures, leaders are reviewing ways to lower costs and pass price increases downstream to customers. Some of the cost has been deferred to the customer with increased pricing, but companies are still taking a cut in their profit margins.

Prices have gone up about 8% in 2022 which is the highest inflation seen in almost four decades. It’s putting a lot of pressure on people and companies alike. Wages have gone up for a lot of industries, but they’re not going up as much as inflation has gone up.

Recession expectations are high. We polled a group of leaders, and more than 80% said they expect to see a recession in 2023. The Conference Board reported that about 60% of the CEOs polled expect a recession by the end of 2023. Most of the C-suite expect some sort of recession in 2023.

Supply chain

Expect an emphasis on supply chain resilience at a critical response level for leaders to gain momentum. Priorities will be focused on more environmental and social responsibilities as well as on transparency.

We’ve seen a lot of disruptions in the supply chain due to the pandemic, and it’s forcing businesses to adapt. Business leaders must take what they learned from the pandemic and improve supply chains to be more sustainable moving forward. Some companies are in-sourcing to shift dependency off vendors and on the flip side, some companies are totally outsourcing supply chain jobs because it’s been hard to fill those positions.

Circular supply chain is trending more now versus a linear supply chain. An example of this would be that instead of discarding items at the end of a cycle, those items are being refurbished and used as part of raw materials versus just scrapping them and buying new raw materials.

Technology will continue to play a significant role in improving supply chains. This includes software integration and having one platform or system to be used for invoicing and payment. It also includes end to end supply chain management and visibility tools.

Environmental, Social, and Governance (ESG)

About 70% of middle market business leaders are focused on ESG initiatives with economic opportunity and equality as a top priority. Additional areas of focus include labor conditions, gender equality, public health, human rights and racial equality.

Consumers are making purchasing decisions by prioritizing factors such as ecological impact and sustainability when they choose who to buy from. In addition, environmental, social and governance factors can have a material impact on future business profitability due to the global and interconnected nature of many industries. The war in Ukraine is an obvious example, but natural disasters as well as unsustainable fiscal policies also create market risk.

Having an ESG process strategy in place (or beginning to develop one) will be important for leaders to consider in 2023. Several ESG reporting frameworks and disclosure requirements are already in play to standardize global reporting in the future, making a proactive strategy important in the C-suite.

Cybersecurity and risk

Cybersecurity has been a consistent topic in businesses for the past few years and will likely continue as technology advances. Many attacks are due to human error and are preventable with training.

User Awareness

Larger amounts of money are being allocated in company budgets to be spent on cybersecurity and security awareness training to prevent cyber-attacks. Companies are increasing user awareness on phishing and other types of scams and improving password strengths.

Attacks on Healthcare

Certain sectors will be more vulnerable to cybersecurity because of the amount of information and the type of information that they deal with. The financial sector and healthcare sectors have seen a significant increase in the number of cyber-attacks. In the last three years, healthcare companies have seen attacks increase over 80%.

Cloud Security

As more and more businesses move data storage to the cloud, careful attention to sensitive data being transferred to the cloud is a must. Continue to expect more security improvements and innovative ways to make sure data is secure and to prevent cyber-attacks.

General Data Protection Regulation (GDPR) Continues

GDPR is a European Union data privacy policy with global implications for all businesses. And while it is aimed at EU citizens, it affects any global business that operates in a European market.

Targeting of Mobile Devices

Over two thirds of the world owns or uses a smartphone. As we see more devices connect to a network, more opportunities for someone to gain active access to data that they shouldn’t have increases. Smartphones are becoming the method of choice for cyber attackers because they’re able to gain access to a lot of data. Companies must continue to ensure they have procedures in place to prevent access, as well as train employees to make sure they understand potential cyber-attacks.