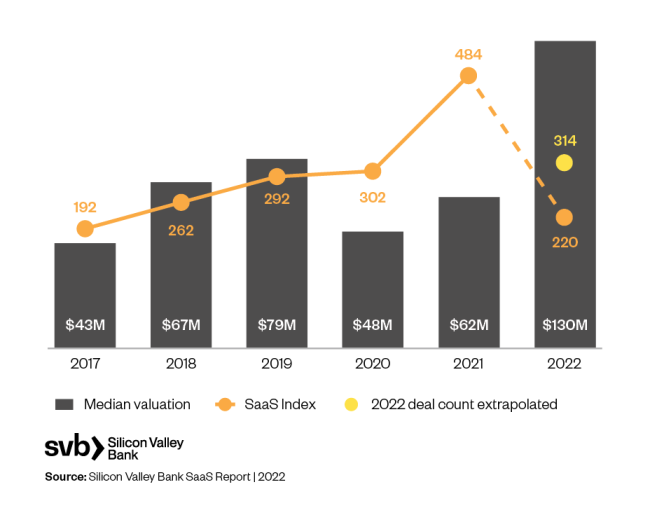

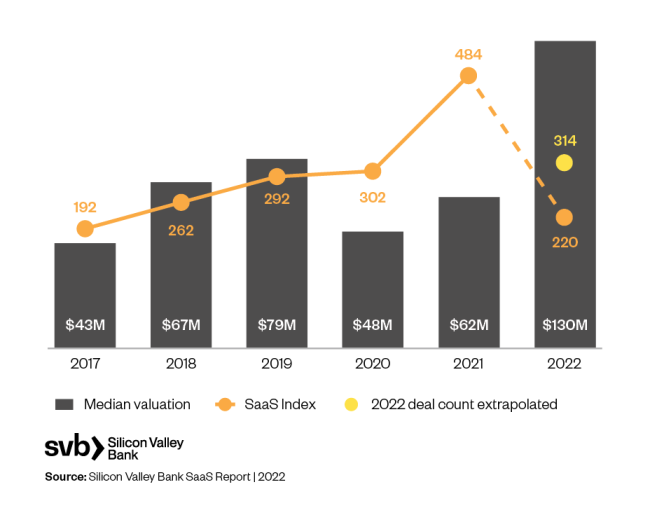

While the total number of M&A deals are on par with recent years, the underlying narrative has shifted.

The typical reason for a merger or acquisition was to break into new markets, make a splashy exit, or expand product offerings. However, given the current volatile market, many struggling SaaS companies are putting themselves on sale out of necessity, and PE firms are pitching their smaller portfolio companies to recoup a loss or turn a profit.

Enterprise Software M&A

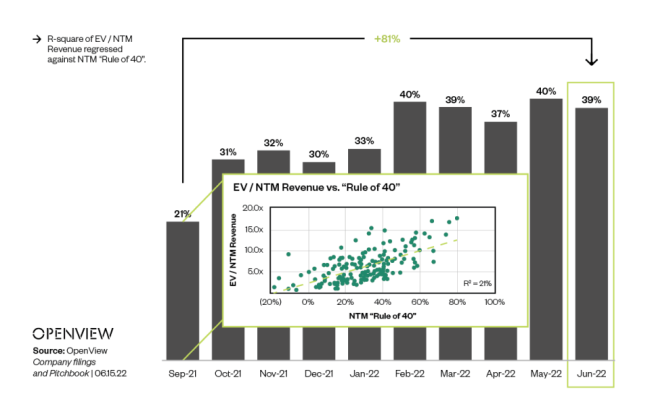

While these sentiments may not ring true for SaaS companies in the top quartile of growth, the same can’t be said for businesses that are in the middle of the growth bell curve.

For the average SaaS company, the new path to IPO is probably not as a standalone business, but as part of a larger entity. This shift in perspective means getting acquired is the goal that many finance leaders and VCs have in mind as they plan out their future financial roadmap.

In more extreme cases, GPs are actually handing capital back to their LPs. Unless a favorable investment opportunity presents itself, VC firms are giving the dry powder back to their investors to maintain relationships and capture future ROI instead of taking the risk of a premature investment.