Whether you are a new user or even a long-time user of Microsoft Dynamics GP, it’s easy to just be familiar with the core features that you were set up with and work with what you know. There are some common underused features in Microsoft Dynamics GP that can save you time, improve accuracy and make your life easier! These features will help you improve your processes for general ledger, accounts payable, accounts receivable, bank reconciliation, and reporting.

Common Underused Dynamics GP Features

How to Track Revenue & Expense Deferrals within Dynamics GP

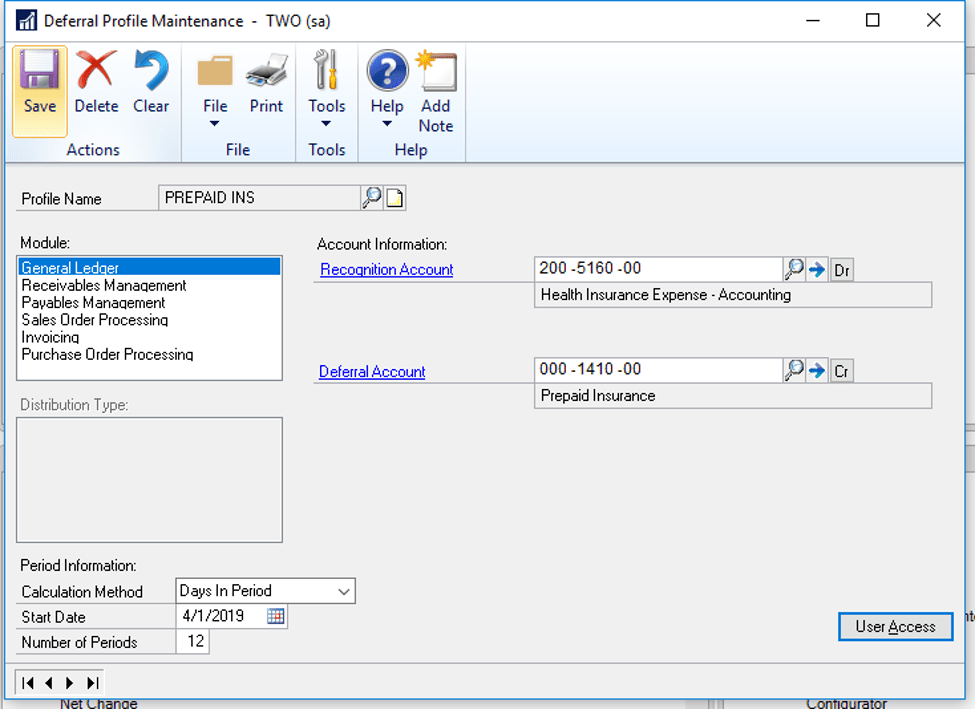

If you are using Excel spreadsheets to track revenue and/or expense deferrals, you should look at the Revenue and Expense Deferrals module, an often-overlooked Microsoft Dynamics GP module. Revenue and Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period of time. Revenue or expense entries can be made for future periods within General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. It can even help you automate preparation of the International Financial Reporting Standards (IFRA) statement.

In the Revenue and Expense Deferrals module, you can determine which assets and expense accounts to use, the dates of when the deferral should occur and the deferral amount. It also has the capability to set up deferral profiles, which would be templates of commonly deferred transactions for you.

This Revenue and Expense Deferrals module makes it quick and easy to calculate and automate the deferral entry process. You don’t have to defer an entire amount, you can defer just part of the transaction amount. Prevent having to make adjusting journal entries at month-end to make these distributions.

Workflow in Microsoft Dynamics GP

Workflow inside of Dynamics GP is simply a rule or set of rules set up to kick off once an action is taken in GP, such as posting a payables batch or setting up a new vendor.

Have you ever wondered how workflow can help improve business processes within your organization? Setting up approval processes or individual workflows can cut down on fraud, duplicate entries, and automate and streamline processes.

It can be modified to meet your unique needs and probably my favorite feature is that you are able to do approvals remotely. This means that you can approve or deny right from an email on your phone, without ever having to log into GP.

Workflow is flexible in the fact that you can set up things like conditions, for example, when a check is above a certain dollar amount, it must be approved by 1 or maybe 2 people before it can be posted. You can also set up back-up approvers in the event someone is out of the office or on vacation. And for those coworkers who rarely check their emails (you know who they are!) you can even escalate an overdue workflow step to make it top priority.

The most popular uses for workflow are:

- GL Batch

- GL Account Maintenance

- Receivables Batch

- Payables Batch

- Vendor setup

- Purchase Order

- Requisition

In the October 2019 release of Microsoft Dynamics GP, Microsoft added security workflows (hallelujah!). This means if someone adds or makes changes to things like user security, or security roles, it can be set up to be approved by management first.

Multidimensional Analysis Feature

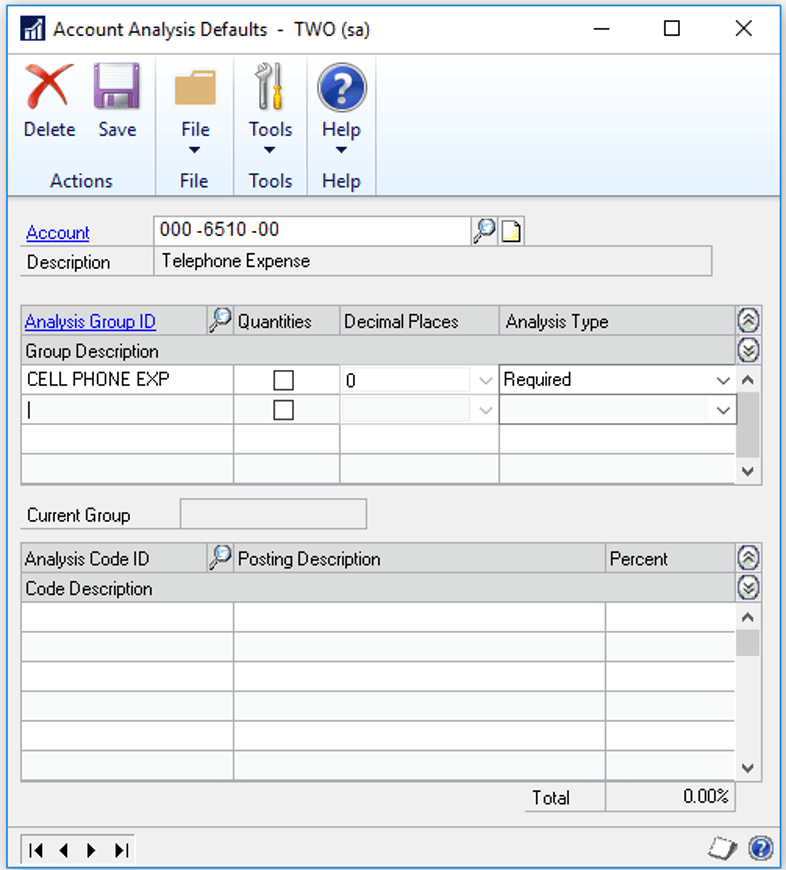

Multidimensional Analysis (also known as MDA) is a feature in Microsoft Dynamics GP that allows the end user to track more granular details of a transaction related to a specific General Ledger account without adding or defining a segment of the GL account to do so. An example of this would be as follows.

You have a need to break down your cell phone bill and track the expense by cell phone line in addition to the lump sum of the phone bill itself. The first thought would be to add a segment of your GL account number to do this, but we all know that can become cumbersome, not to mention the clutter it will add to your chart of accounts. In this scenario, we can setup MDA to track the cell phone lines (dimensions). First, you would create your Analysis Groups (Cell Phone Expense) and within the Cell Phone Expense Analysis Group, you would create the Analysis Codes (the cell phone numbers). The last step would be to link the GL account number (Analysis Defaults) that you would post the entire cell phone bill against. This is what will allow the end-user to allocate the entire expense to the different cell phone lines when entering the transactions GL Distribution.

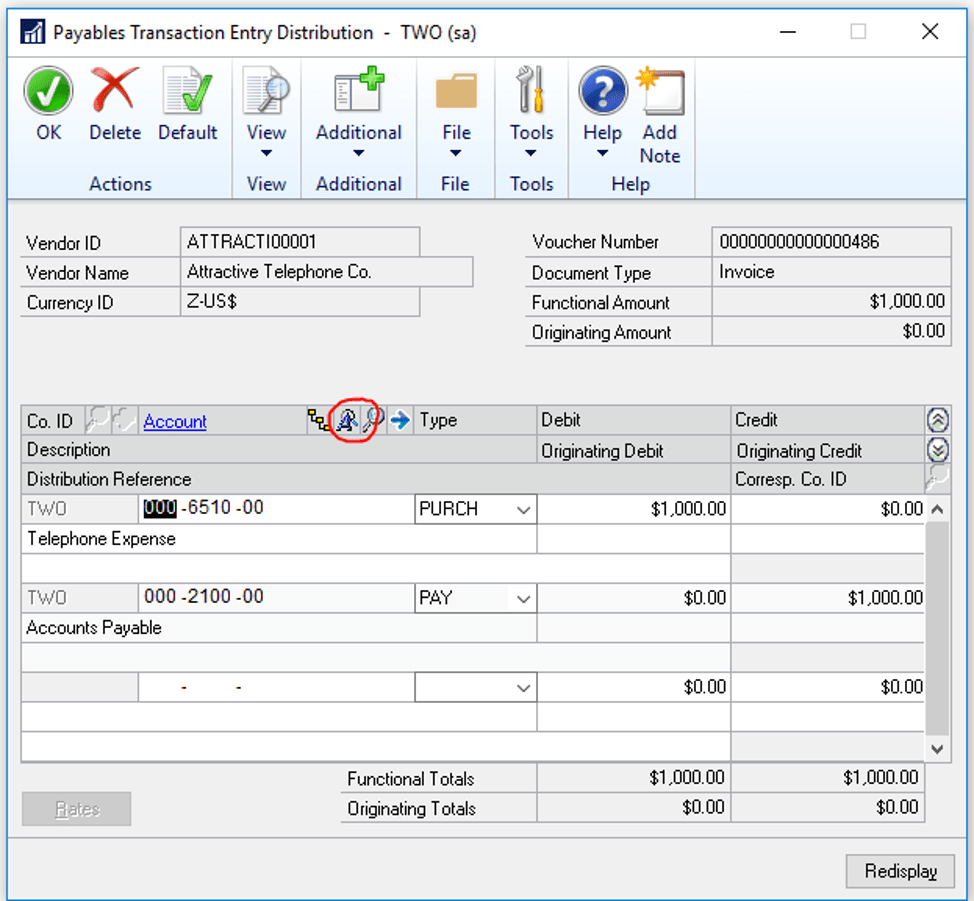

Let’s take a look at how this looks in the Payables Transaction Distribution. The “A” icon that is circled in the below figure is indicative of this being a transaction that needs to be further defined. The end-user would click on the icon to open the MDA Posting Analysis window.

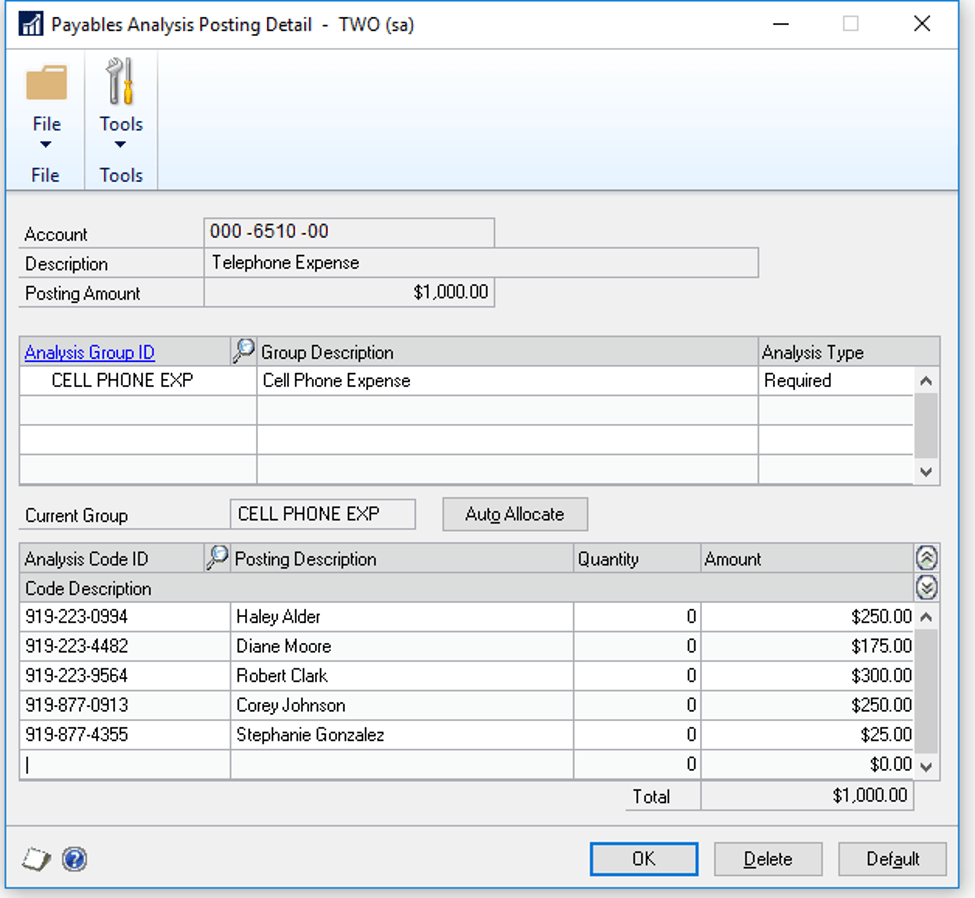

Below is what the MDA Posting Analysis window looks like and here is where the breakdown takes place to allocate the cell phone expense.

Once the transaction is posted you can report on it using Report Writer reports or SmartList reports that can easily be exported to Excel.

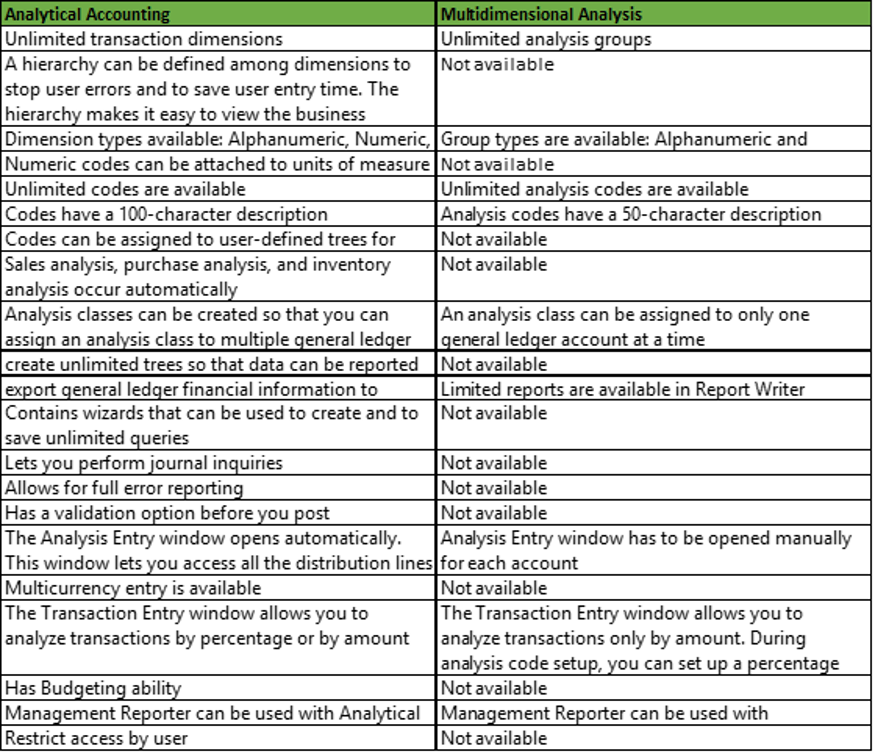

There is also a module called Analytical Accounting that can do this as well, but it does take a bit more to implement. Although it has much more functionality, it may be more than what you need. A needs analysis would help determine which feature works best for your scenario. Below is a list of the differences between the two modules.

Grant Management Module

Receiving grants is very rewarding and sometimes crucial to your organization, however, tracking and measuring grant progress can be a great frustration. Are you currently tracking grant progress in Excel spreadsheets for the reports that you have to send back to the fund provider?

The Grant Management module inside Microsoft Dynamics GP is an automated management system that empowers you to make faster and better decisions on the spending of your grant on a daily, monthly, and yearly basis. These processes will help you track funds more easily, demonstrate accountability, prevent overspending and help attract future funding.

Don’t worry about potential budget overruns anymore because in this module you can set automatic alerts to warn you. Keep a close eye on expenditures by tracking specific grants against specific programs.

All your data is stored in a centralized location so you can access up-to-date information to ensure better work productivity and produce timely reports. Then with more accurate views of your grants, you can start making proactive decisions instead of reactive decisions.

We can help you set up Grant Management. Spend more time reporting the success of your organization not tracking down data.

Fixed Assets Module in Dynamics GP

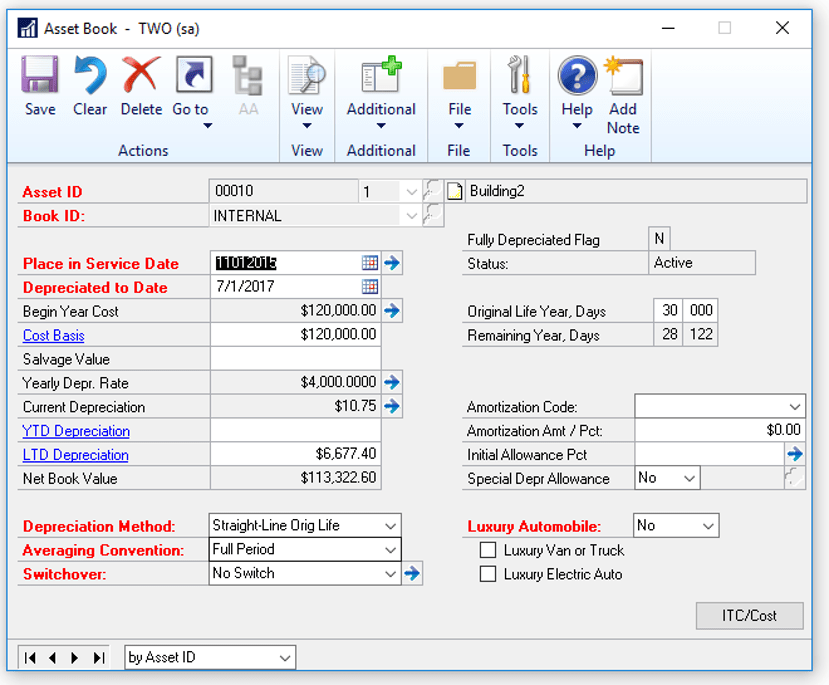

Are you struggling with managing your company assets? Are you still using Excel spreadsheets to track asset depreciation? Are you tracking simple depreciation but need more complex depreciation calculations? Implement the Fixed Assets module in Dynamics GP to ease the month end frustration and better manage assets such as buildings, machinery, equipment, computers/laptops, etc.

The Fixed Assets module fully integrates with the Purchasing module and the General Ledger, making it easy to start depreciation as soon as assets are purchased and keep constant tabs on depreciation, add new assets, transfer assets, or retire older assets.

During budget season, this module is a huge help because it can project future depreciation. Fixed Assets can also handle multiple depreciation methods such as for state tax or straight line. You can retire older assets in bulk as well as group assets together with the same method of depreciation, life, and account numbers for quick assignment.

Accidentally retire an asset before you had your morning coffee? There’s an undo button for that. You are able to unretire an asset or undepreciate an asset if needed.

Last but certainly not least, there are a ton of easy-to-use pre-built reports in Fixed Assets or SmartLists to help tie out to the general ledger.

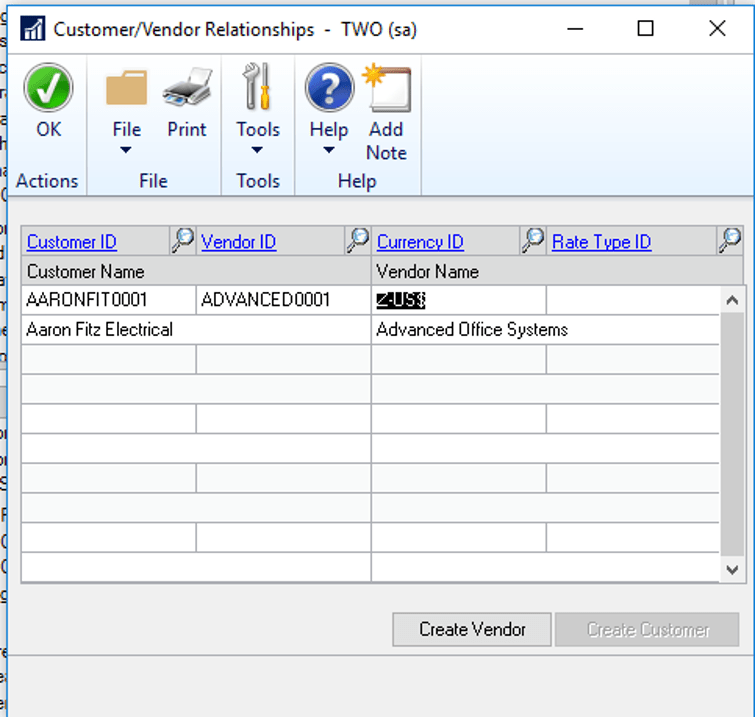

Customer Vendor Consolidation Feature

Do you have customers that are also vendors? Do you have vendors that are also customers? GP can handle that! With the customer/vendor consolidation feature, you can transfer information between vendors and customer as well as consolidate balances to avoid having to create unnecessary credit memos and debit memos. It is a simple module to set up and our team would be happy to discuss with you further if you think this could save you some time!

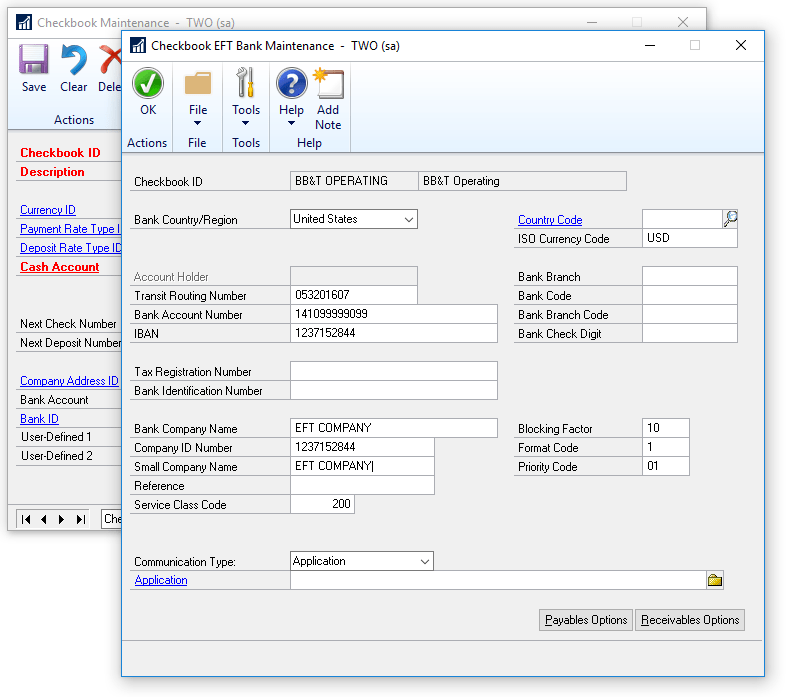

Electronic Funds Transfer (EFT) for Payables

What is EFT for Payables, you ask? Well, it is a really easy way to pay your vendors electronically, rather than printing manual, paper checks. Payees typically prefer this method and it will help you reduce check fraud, use less paper (saving the environment!) and save on postage.

You will also gain some efficiencies in your accounting department by cutting down on time spent on manual tasks associated with the check printing process. Sending an EFT rather than a check from Microsoft Dynamics GP does not differ much from your current processes at all. Once set up, all you have to do is create an EFT batch instead of a check batch, generate the file, upload it to your bank, and the bank distributes the funds… that’s it!

To get prepared to set up EFT for payables in Microsoft Dynamics GP there are a few steps to take before getting started. First, contact your bank, as they may need to do some testing of your file formats beforehand. Next, gather banking information from the vendors who want to be paid via EFT. Hint, use the Write Letters feature at the top of the Vendor Maintenance window to make your life easier. Finally, set up the file format within Microsoft Dynamics GP to meet your bank’s requirements, that is where we come in, let us help!

What is EFT?

EFT (Electronic Funds Transfer) for Payables Management makes it easy to pay your vendors electronically via ACH, rather than printing manual, paper checks. Sending an EFT rather than a check from Microsoft Dynamics GP does not differ much from your current processes at all. Once set up, all you have to do is create an EFT batch instead of a check batch, generate the file, upload it to your bank, and the bank distributes the funds… that’s it! Email remittances are available directly out of GP for your convenience. With EFT, you can reduce administration cost, simplify bookkeeping, increase efficiency and gain greater security.

Benefits – Payees typically prefer this method as it is quicker and you are able to process invoices and payments from anywhere. Using EFT will help you reduce check fraud, use less paper (saving the environment!) and save money on postage, envelopes, check stock and even printer toner. As an added bonus, you’ll spend less time on manual tasks associated with the check printing process so you can focus on other priorities.

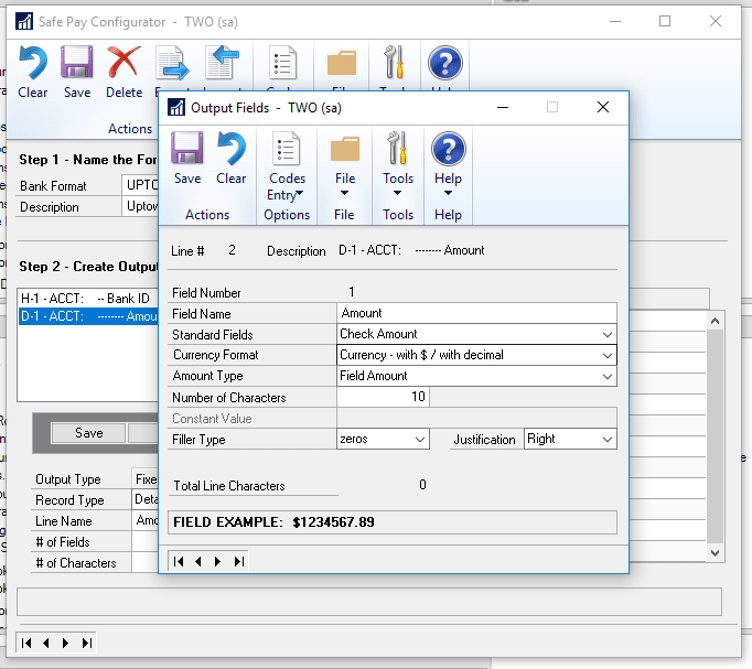

Protecting Your Business from Check Fraud with SafePay

Did you know that more than 500 million checks are forged annually in the U.S.? With SafePay, you can be proactive in protecting your business from check fraud.

It is more difficult to try to collect funds from a fraudulent check once it hits the bank. SafePay allows you to set up a clean process with the bank to prevent this from happening. With SafePay, you can easily add the functionality to protect from check fraud, including daily exporting of checks for comparison by the bank when checks are presented for payment. SafePay creates the file you need to upload to the bank that details the transactions as frequently as you’d like. The bank can then reference this file when checks are presented for cashing and verify the details match between the two documents to avoid fraud.

You can’t afford not to do this. Save yourself the extra work and use SafePay to automatically generate the file you need to upload to the bank – plus you already own it with your Microsoft Dynamics GP license as part of the eBanking suite.

Scheduled Payments Feature

If you are making large payments to a vendor on a scheduled basis, such as for a vehicle or other large piece of equipment, you may want to take a look at the Scheduled Payments feature in Dynamics GP.

The Scheduled Payments component of the Accounts Payable module will allow you to create a schedule based on the amount of the loan, the interest rate and the term of the loan. It will produce an amortization table as well as allow you to default the transaction information to save you time.

If this is something you think you may be interested in taking advantage of, we’d be happy to talk with you further to see if using scheduled payments is right for your organization.

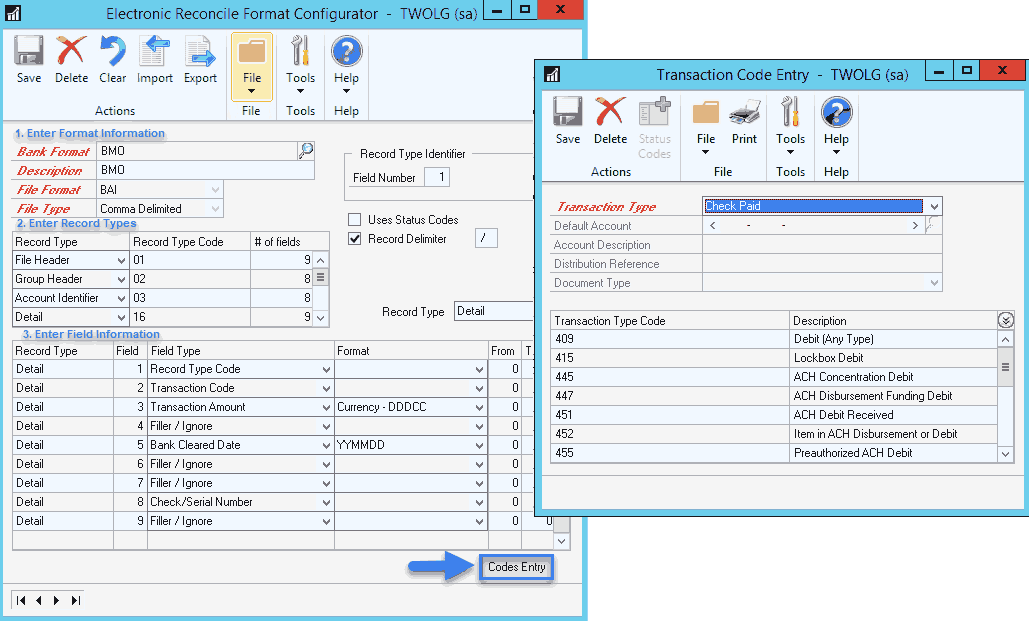

Electronic Bank Reconciliation Module

The Electronic Bank Reconciliation module in Dynamics GP is easy to set up and can save you a lot of time and headache whether you reconcile monthly, weekly, or even daily.

You already own this module, you just need to get it set up. The only difficult part can be configuring the file format from your bank to match what GP needs but that is where we come in! Let us take care of that part.

In short, the EBR module automatically reconciles cleared transactions between the checkbook or cash sub-ledger and the bank statement. An error report is run after the bank file is read and matched, identifying any differences, making it easy to correct.

What is Electronic Bank Reconciliation?

Electronic Bank Reconciliation is designed to be one module in which all transactions appearing on your bank statement can be imported and automatically reconciled. The transactions can be matched in Electronic Bank Management with the transactions in the holding account or posted to the GL or cash account. This module also integrates with Analytical Accounting.

Benefits – You can use Bank Reconciliation to enter and maintain checkbooks that are used to pay vendors, employees, distribute petty cash and to reconcile bank statements. Payables Management and Payroll, checks printed and posts from those modules, update checkbooks in Bank Reconciliation, allowing you to reconcile faster and with fewer errors.

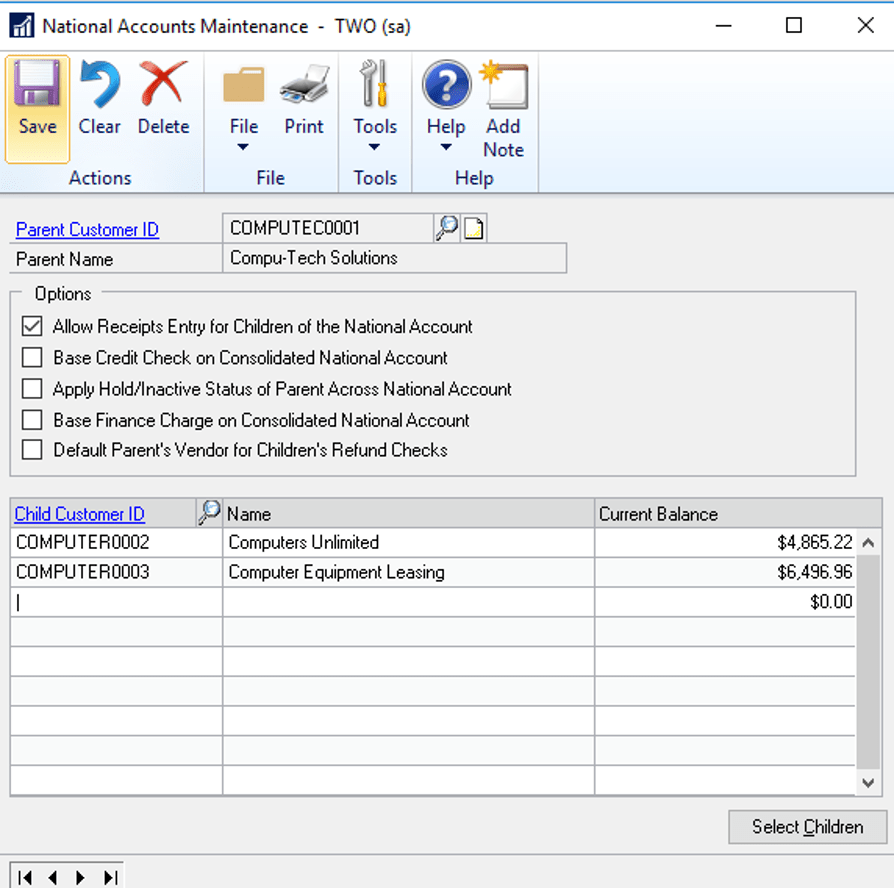

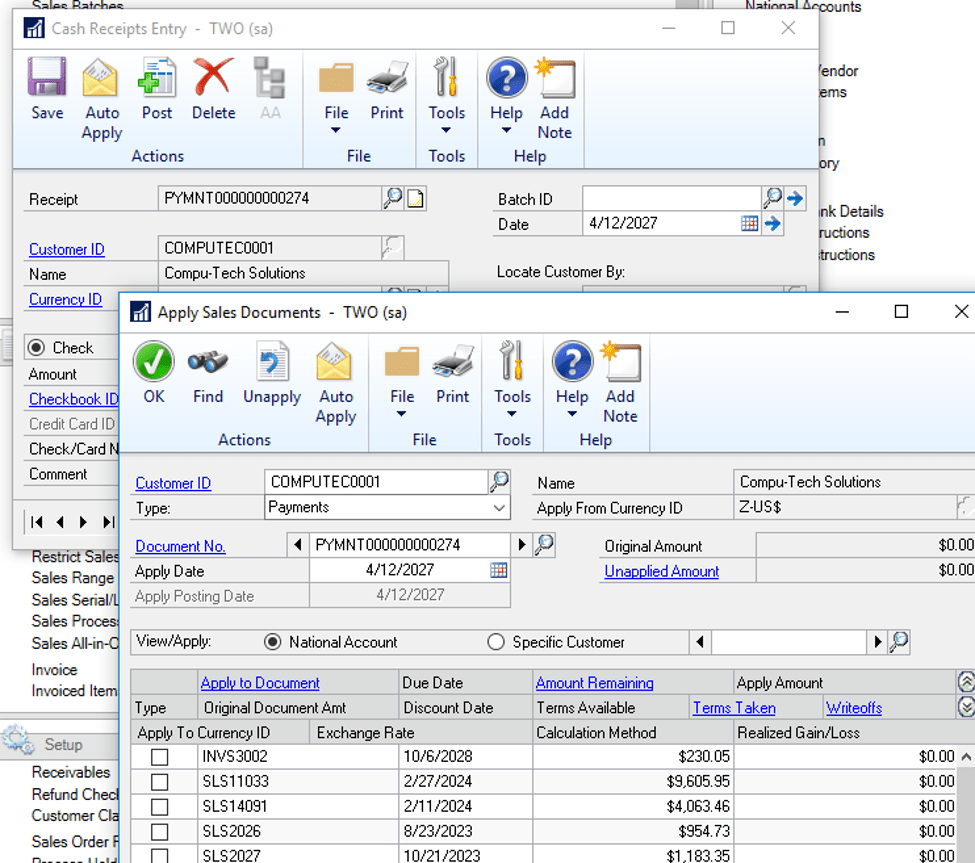

National Accounts

If you’re selling to a large company with a lot of branches or subsidiaries, you should definitely take a look at National Accounts in Dynamics GP.

At my prior company, I worked as an accountant using GP and we had several major retail stores on our customer list, including Lowe’s Home Improvement. Let’s say 50 individual stores would order goods from us, so they were all set up as separate customers in GP. So far, so good. The challenge came in when Lowe’s Corporate sent us a check to pay for the goods for all 50 stores – they were not all the same customer, so we had to set up and start utilizing National Accounts.

The corporate office was set up as the parent account with all of the stores underneath it as “children”, what this allowed me to do was apply the corporate payment to any child customer invoice in GP. It was extremely easy to manage and operate and saved me a ton of headache and wasted time.

PO Generator

There’s inventory on hand, there’s minimum quantity levels, there are sales orders pending, there are purchase orders outstanding. With all of that going on, it can be a headache to manage your inventory levels. Fear not! With Microsoft Dynamics GP, all of that inventory data can be captured in the system and (wait for it), you can have the system suggest orders for you!

In all seriousness, with GP’s PO Generator feature, the system itself looks at your on hand quantities, your min/max levels that you have set for each item, any POs that are open from your vendors (ie, more inventory on its way) and orders that your sales reps no doubt have coming in like crazy. Once GP (and not you) looks at all that data, it offers a screen of suggested purchase orders to get your inventory levels into perfect harmony. You get the chance to review, approve and voila – you’re ready to send the POs off to your vendors.

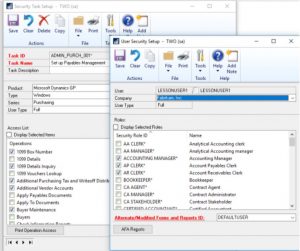

Security Feature

Does Microsoft Dynamics GP Security have you pulling your hair out? While Security Setup can be complicated, it is with good reason. Not all GP users need access to everything. Typically, a good practice is to deny access to administrative tasks or module setup to end-users that perform transactional type entries. Security is defined by roles and each role is made up of tasks. The tasks contain the different windows, reports, files and resources a user has access to within Microsoft Dynamics GP. The role is assigned to the user. Trying to figure out what all of the different tasks are assigned to the role, can be a daunting task! Although, once you have it right, it can sure make your life easier!

Whether you have not cleaned up Security since you first implemented the system, you would like to understand it better or you want to streamline the process, we can help with all of these.

Account Level Security

Account Level Security in Microsoft Dynamics GP is a great way to restrict users from seeing your entire chart of accounts. Perhaps you don’t want specific users to see payroll accounts or the transactions related to them, then you would certainly want to use Account Level Security to accomplish this. It is another great way to restrict users that only need to see GL accounts that are related to specific departments, locations, a line of business, etc. The setup of the feature can be a little intense, but is well worth the effort to set it up.