Built to Last

LBMC knows real estate and construction from the ground up. With numerous real estate and construction clients, we’ve learned how to create opportunities and provide best practices that benefit you.

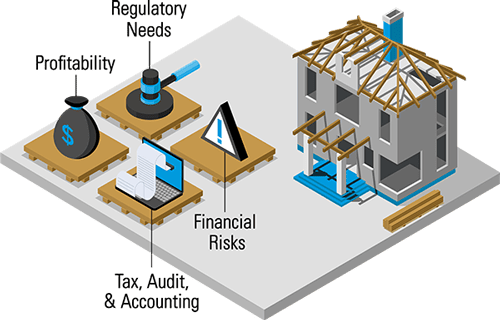

For over 30 years, LBMC has worked with a wide range of clients in the construction industry. Our goal is to help these clients address challenging regulatory requirements, assess financial risks, increase profitability and grow their businesses.

Whether it’s acceleration of depreciation deductions, property tax abatements, grants for infrastructure improvements, or energy efficiency credits, our deep industry experience and expertise can help. From inception to completion, we see your projects through with accounting, auditing, tax planning, payroll, technology, and management support that alleviate the burden on you. We provide comprehensive services that are customized to meet your needs.

Solutions for Real Estate and Construction Industry

CASE STUDY: R&D Tax Credit for Construction & Real Estate

This success story reviews an architecture/engineering service company located in Nashville, Tennessee that reached out to our team for an R&D Tax Credit Study. The company had annual revenue of $148 million in 2017 and has grown significantly. They employ 1,150 employees of which 650 are included as qualified.

Approach

Our team of R&D consultants conducted group meetings with leaders from each market segment, key members of the Innovation Board, and financial team in order to educate and advise on the qualifications of the R&D Credit and how to apply it to their business. In these meetings, we discuss project qualifications and determine which projects qualify across markets. This information is used to analyze their internal time-keeping data and quantify a qualified research percentage for each applicable employee.

Results

- $13 million in qualified research expenses (QREs)

- $1.1 million in gross federal credits

- $40 thousand in gross credits from 4 states in 2021

View the entire case study here.

Indications of an R&D Tax Credit Opportunity

- Do you employee engineers, scientists, project supervisors, or programmers?

- Do you develop or improve products or processes?

- Do you incur raw material costs during the product development process?

- Do you build prototypes, jigs, models or dyes?

Since 2014, McGuire Sponsel and LBMC have partnered to provide first-class service with integrity that brings value to LBMC’s clients. As a national specialty tax consulting firm, McGuire Sponsel offers Research & Development Tax Credits, Fixed Asset Services including Cost Segregation, Global Business Services and Credit and Incentive Services. Contact us for more information.

What make us different?

As a top 50 firm in the country, LBMC is dedicated to providing services tailored to our clients. Since we work with a wide variety of Real Estate and Construction clients, LBMC has invested significant resources to meeting the needs of this industry. Key differentiators for LBMC include:

- Diverse Experience

- Bigger Picture Vision

- Competitive Pricing

- Dedicated to Deadlines

- Intense Attention

Who we serve

LBMC industry experts have experience working with a variety of Real Estate and Construction Clients. Our industry experience includes serving companies such as:

- Asset Management Companies

- Commercial & Residential Construction

- Commercial & Residential Real Estate Owners/Investors

- Developers

- Engineering & Design Firms

- Family Owner Real Estate Entities

- General Contractors & Subcontractors

- Operators

- Property Management Companies

- Property Management Companies

- Commercial and Residential Real Estate Owners/Investors

- Family Owned Real Estate Entities

Featured Blog Posts

If you are not a client and are interested in more information on our services, complete the form below to have an LBMC sales team member contact you.