The right ERP (enterprise resource planning) software should save you time and effort. It can ensure accuracy, give real-time data and improve efficiency. But keep in mind that because every business is unique, you need a financial management solution that works for you.

Let LBMC Technology Solutions show you the different benefits of ERP. LBMC Technology Solutions can educate you on ERP software solutions and help you determine which one is best for you. We start with a business discussion to assess your needs and objectively recommend the solution we feel best fulfills your business functions. Then, we work with you to plan for, implement, integrate, and support the software.

LBMC Technology Solutions is an IT solution provider that works with you as an extra part of your IT team. Our years of being a Microsoft partner and our cross-industry experience will help you maximize our accounting solutions.

It May Be Time to Move On from Your On-Premise Finance System

As the size, complexity, and pace of your organization grows, frustrations around legacy software solutions can multiply. Companies often rely on many different functionalities. Consolidating multiple entities, project-based accounting, real-time reporting, process customization, automated approvals, and integration with other software products. In today’s fast-paced, complex world, you can’t afford spiraling costs, functional limitations, manual work, and spreadsheet inefficiencies.

Is it time to move on? Take a look at these five signs to see if your current system is holding you back.

Choosing the Best ERP Software for Your Business

There are many factors to consider when choosing an ERP system. You must consider your business units and your business requirement. Let our experienced client strategists and certified ERP consultants help you find the right fit for your unique business.

Financial leaders today balance the need to manage an increasing level of business complexity with the need for speed. You’re expected to keep your eye on multiple entities with multiple regulatory frameworks and multiple currencies.

Think that’s complicated?

Now add frequent changes to the equation. A monthly financial check-in isn’t good enough for today’s CFO. You need the agility to make decisions at a moment’s notice. Those decisions must be based on the real-time financial truth.

Here’s the question. In today’s complicated business climate, is your accounting software helping you grow and compete—or holding you back?

This guide will help you understand whether it’s time to make a move. You’ll discover:

- Why do most financial software systems hinder your ability to get good financial information?

- The six key questions you need to ask before considering a move to a cloud-based financial solution.

- Why the process for evaluating software is different for cloud solutions?

- Seven things to make sure you’ve got in writing.

The last major adoption of financial management and accounting software was in the late 1980s, the shift to Microsoft Windows. Every major financial software package today arose from this transition. QuickBooks, Microsoft Dynamics, SAP, and Oracle all pre-date the Internet.

The problem with these systems is that they were never designed for today’s always-on, always-connected, always-working world. Instead of being able to configure your system on the fly, you have to pay for costly, permanent customizations.

As a result, you find yourself held back by vendor lock-in. This lack of flexibility also makes it difficult to get the reports you need. You need the right information at the right time.

And that’s precisely why so many companies are trapped in the past. They’re struggling with old-fashioned, outdated financial management and accounting software packages.

The fallout from using one of these older systems includes spiraling overhead costs, functional limitations, and unnecessary risks. There’s a cost to not being able to gain real-time visibility into your organization’s financial and operational KPIs. It’s the cost of having your competitors make faster, better decisions than you.

If you are considering a new financial management system, there’s one decision you can, and should, make early on. Which delivery model will provide the highest ROI for your organization?

Here’s a high-level overview to help you understand your three main options.

On-premises solutions

With this traditional model, you license software and run it on your own servers. When considering this model, be sure to account for the capital and operating expenses. These expenses are associated with deployment, operations, support, customization, integration, maintenance, and upgrades.

While these costs can be high, on-premises solutions remain a viable option for some larger companies. These organizations often have a built-out IT infrastructure, investment capital, and expertise to support and maintain major software applications.

Hosted solutions (single tenant)

In a hosted environment, the software physically resides at a remote data center operated by an expert third-party hosting provider. Your team would usually use a product like Citrix to access the software over the Internet.

This model eliminates the responsibility of maintaining hardware infrastructure and therefore can help you avoid large upfront capital expenditures.

But it works by providing you with a unique “instance” of your financial system on a dedicated server. That means you would still face the same costs for customizations, upgrades, integration, support, and service.

Cloud computing solutions (multi-tenant)

Just like Google, Amazon, and online banking, cloud-based financial applications were built for the Internet age. These applications offer direct, always-on access to the solution, typically paid for on a per-user/per-month subscription basis.

They are multi-tenant, which means you can unlock only your own data. However, you work from a shared system; a single set of resources, application infrastructure, and database.

There are no upfront fees, capital investments, or long-term commitments. You do not buy, license, or manage the underlying hardware, software, or networking infrastructure. Upgrades are performed at no cost to you. Even if you make extensive changes to the system, your customizations “roll over” to work with the new upgrade.

Considering Cloud ERP

The cloud offers compelling and unmatched advantages for deploying business software, and particularly financial applications. Financial services firms using cloud financials often give their management team real-time dashboards to view relevant performance indicators.

Demand for cloud-based financial applications continues to grow, to access and analyze massive amounts of data in near real-time. Organizations need faster finance systems to win business worldwide. They are increasingly turning to the latest SaaS and cloud-based systems.

(Source: IDC MarketScape: Worldwide Cloud and SaaS ERP Accounts Receivables and Accounts Payables Applications 2018– 2019 Vendor Assessment)

While your next financial solution very well could be a cloud solution, it doesn’t have to be. And it certainly should not be a choice based on “what everyone else is doing.” Is the cloud right for your finance organization? Conduct a quick gut check with these six questions.

- Does my team need to work outside the office?

“Anytime, anywhere” accessibility is a key benefit of moving to the cloud. The finance team can work remotely with only a web browser and an internet connection.

connection. You don’t need extra security hardware or software, or a VPN connection.

- Does my business need to accelerate financial processes—without increasing headcount or IT budget?

High ROI and rapid payback are common with cloud applications. In a recent study by Nucleus Research, cloud-based financial management and accounting implementations were found to deliver

3.2x more ROI than on-premises software.

(Source: NucleusResearch.com)

Considerable financial advantages come from avoiding the capital investments and operating expenses associated with an on-premises system. But cloud systems also drive higher ROI through time savings and process efficiencies.

Since cloud systems are inherently Web-based, live, and real-time, they greatly accelerate crucial financial processes. Processes like collections, consolidations, and period closes. Plus, modern cloud-based systems offer extensive automation and integration capabilities. You can go a long way toward eliminating productivity busters like manual data entry, paper-based processes, and spreadsheet maintenance.

- Does my financial system need to integrate with Salesforce.com or other applications?

Easy integration comes with the territory in the cloud. APIs and Web services enable cloud systems to easily integrate with one another. Your company can use the best applications for each functional area of the business. That means no more costly custom programming and maintenance from expensive IT resources.

- Do my managers want or need self-service access to their relevant KPIs?

Real-time visibility is a hallmark of today’s cloud systems. You can provide access not only to traditional finance department users but also to other stakeholders across the business. For instance, many financial services firms that are adopting cloud financials provide real-time dashboards for their management team. This way everyone can see the key performance indicators that apply to their department.

Employees can access a range of services to view dashboards, approve expenses, and create purchase orders. They can also provide real-time access to key information for lenders, auditors, CPAs, and board members to strengthen trust.

- Does my organization struggle with inefficient processes?

The cloud can help you gain company-wide operational efficiencies. You can streamline classic finance processes—such as consolidations and closes. But you can also leverage the Internet to tie in other company functions and processes. For a few examples, you can coordinate purchasing workflows that involve all stakeholders.

You can deliver a 360-degree order-to-cash process that connects finance and sales. And you can create budget dashboards for department managers and help increase operational alignment.

The cloud enables companies to sidestep the pitfalls of “management by spreadsheet”. Avoid the limitations of single-user systems like QuickBooks Online that trap information in desktop silos.

- Do we need to compete with bigger businesses—on a smaller budget?

A cloud-based financial system lets you tap into a world-class infrastructure. Your vendor amortizes costs over thousands of customers., They can maintain world-class infrastructure and provide you with 24×365 operations, continuous backups, disaster recovery, and superior security.

This offers you a far higher level of performance, reliability, and security than you may normally have. Plus, cloud applications can be provisioned immediately and are upwardly and downwardly scalable. So you can get started quickly and change on a dime.

Evaluating Solutions

When it’s time to evaluate vendors for your financial system, remember you are ultimately choosing a sophisticated software application. Even with cloud-computing implementations, the basic process of vetting vendors remains unchanged. Consult the basic evaluation checklist below. Then be sure to continue to the next section for additional questions you should ask cloud vendors.

Gather requirements

Carefully define and document your needs. Get input and gain consensus from key users in finance and related departments across the organization.

Do you need to integrate with CRM systems? Talk to sales. Do you need to deploy new purchase requisition processes? Talk to accounts payable.

Identify top priorities and challenges

No system meets every need of every user. Determine which functionality and requirements best fits your finance team’s needs.

Create an RFI/RFP

With requirements established, now’s the time to list your needs, expectations, and parameters on a Request for Proposal (RFP). Using the same form for all vendors will allow you to make an apples-to-apples comparison of solutions.

Research your options

Go online to develop a short list, sift through competing

offerings, and comb through independent research and reviews. Connect with people using the products you are evaluating through social networks like LinkedIn and Twitter. For real-world reviews by actual users, check out Proformative, TrustRadius, and the Salesforce.com AppExchange.

Demo or trial from shortlist

There’s no substitute for careful evaluation of the user experience. But also be sure to see how things work at the administrative level as well.

Focus on product fit

Don’t overlook the basic truth—regardless of the deployment model, there’s still no substitute for functional excellence. You need a financial system that offers the comprehensive, up-to-date features that modern organizations require. For instance, many companies find that multiple entity consolidation and project-based accounting are as essential. As is real-time reporting, process customization, automated approvals, and integration with other software products.

Check references, score, and select

Be sure you carefully screen vendor references. Make certain

that vendors provide access to happy and successful customers but don’t overlook online forums like the Salesforce.com AppExchange, where you can access unscreened, unfiltered feedback about vendor performance.

Vetting Cloud Vendors

When you move finance to the cloud, your vendor – not your IT department – will operate the financial system for you. This fundamental difference should have a major impact on your evaluation process. It’s not like the old days when you licensed software from the vendor and then were on your own.

The vendor has to form a long term partnership with you and continue to earn your business every month. So you need to ensure your vendor can do a better job at running your system than you can.

Seven attributes to look for in a cloud vendor

- Implementation success

The ideal cloud financials solution is designed from the ground up as a cloud application and is backed by extensive experience. Make sure your vendor can point to a proven track record of successful implementations.

- Operational track record

Your chosen vendor isn’t merely developing and licensing software. They’re managing the financial systems that run your business—which makes the partnership strategic for you.

Find out how your vendor conducts business. What’s the cultural fit with your company? What standards do they pursue? Where are the applications physically being run?

- Data ownership

Ensure that it is unambiguous that you own your own data. Ensure you can obtain a copy of your data if your relationship ends. You’ll also want an agreement for appropriate assistance in migrating away from the vendor should you ever decide to leave.

- Infrastructure and security

Most cloud-computing vendors partner with elite data center providers that provide the backbone to their offerings. Find out who those partners are.

Where are the data centers located? What are the business-continuity contingencies? What security standards have they adopted?

Can they deliver guaranteed and appropriate levels of uptime? How do they prevent, detect, and remediate physical and network security breaches? Thoroughly evaluate each vendor’s network operations center and technology infrastructure.

- ROI/TCO

Although the financial models can vary, the total cost of ownership is lower for cloud-computing systems. Take the time to carefully structure proper ROI scenarios and timelines to determine the investments and payback periods.

The only ongoing costs should be monthly fees for the software subscription, training, and configuration. Remember that software licensing for an on-premises solution actually makes up a very small percentage of its total cost.

Additional ongoing costs may include customization, hardware, IT personnel, maintenance, training, tuning, customizations, network maintenance, and much more. And that translates into a far more difficult investment hurdle. Cloud computing costs are taken entirely from OPEX. On-premises deployments typically include even larger OPEX plus significant CAPEX investments.

- Support Agreement

A good support agreement will specify what level of support is free with a subscription. It will also offer several levels of additional support. If it is important to you to have access to U.S.-based experts. Find out where your vendor’s support team is located.

It’s also a good idea to inquire about the people on your support team. Will there be accounting experts and seasoned representatives available to you if needed?

- Service level agreements

Given the stakes, a world-class service level agreement (SLA) is a requirement when dealing with a cloud vendor. With cloud computing, you rely more heavily on your vendor for support. You can’t simply walk down the hall to ask your IT department for assistance if you encounter a system problem.

Make sure your vendor has the appropriate infrastructure to offer the best expertise and responsiveness. And be sure to get an ironclad, comprehensive SLA. As the basis of your relationship, this document can be enforced for many years. It is essential to setting expectations and insulating your organization from risks.

Look for SLA transparency from vendors who are unafraid to publish 12-month histories and current system status on their public websites. If a vendor does not have a public system-status website, it should be a major red flag. They may not have a complete handle on their operations.

Seven SLA must-haves

Your vendor’s Service Level Agreement should specify incentives and penalties for these performance metrics—and more. Make sure you’ve got the following areas covered, in writing.

- System availability

Look for a vendor that can commit to 99% availability or higher.

- Disaster recovery

If there’s a data center disaster, make sure that you’ll be back up in 24 hours. No more than 2 hours of data should be lost as well.

- Data integrity and ownership

If you decide to leave your cloud vendor, you should be able to get your data out of their system.

- Support response

As a general rule, your vendor should be transparent about what constitutes a high-priority, medium-priority, and lower-priority issue. They should be able to respond to high-priority requests within one to two hours.

- Escalation procedures

If you have a support case thatneeds to be escalated, be provided with a clear escalation path and contacts.

- Maintenance communication

Your vendor should let you know when regular recurring maintenance activities take place. They should also post a special notification if any maintenance activity is expected to take longer than normal.

- Product communication

Your vendor should commit to providing regular updates on new product features and product release notes.

Buyer Beware

As the buyer of a cloud solution, you’re in control. Again, cloud vendors must earn your business every month. They are motivated to look past the initial sales transaction and focus on a long-term relationship that keeps you happy.

Make sure that you understand what you are going to be paying for and when.

Two bits of guidance

- Be wary of steep upfront discounts. Protect yourself by ensuring your agreement includes caps on price increases over time.

- Factor in all the variables to avoid surprises. Pricing models for cloud applications vary widely. Some vendors charge an all-in-one fee. Others might break out various components like maintenance, support, or training and then add overage charges. These charges will be based on the number of users or transactions.

See how LBMC Technology Solutions helped Park Cities Baptist Church in Dallas, TX moved to a cloud-based ERP software

Types of ERP

LBMC Technology Solutions is a Premier Sage Intacct Partner

Sage Intacct

Sage Intacct is cloud-based accounting software for small and midsized companies. It delivers the automation and controls needed for accurate billing, accounting, inventory management and reporting to reduce errors, stay audit-ready, and scale with your business. Sage Intacct is the only AICPA preferred financial management solution.

Sage Intacct Overview | Download Datasheet | SaaS | Non-Profit | Healthcare | Financial Services

LBMC Technology Solutions is a Microsoft Gold Partner for ERP

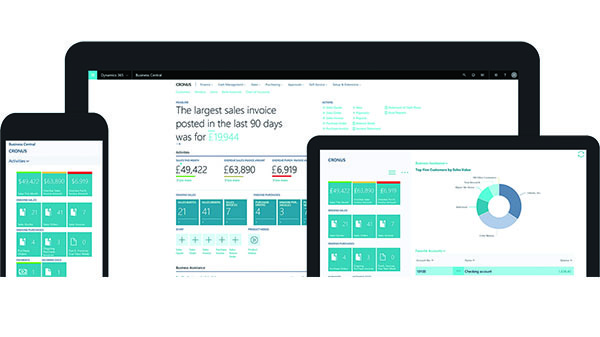

Microsoft Dynamics 365 Business Central

Dynamics 365 Business Central is a comprehensive business management solution that helps small to mid-sized businesses manage finances, operations, sales and customer service in an easy to use and adaptable platform with the ability to add many other integrated systems.

Additional Business Central Information | Download Datasheet

Our certified professionals can help you make the most of your Dynamics GP investment

Microsoft Dynamics GP

Microsoft Dynamics GP is a full-featured financial accounting platform best suited for small to mid-sized businesses. GP is highly scalable with applications for financial management, general ledger, human resources management, manufacturing planning, supply chain management, field service, business intelligence, collaboration, compliance and IT management. Additional modules can be purchased separately, along with the ability to integrate with hundreds of independent software vendors (ISV) applications.

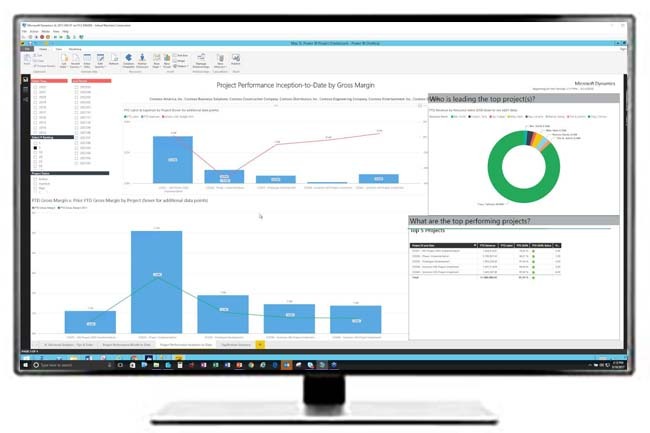

Microsoft Dynamics 365 Finance

Automate and modernize your global financial operations with Dynamics 365 Finance. Monitor performance in real time, predict future outcomes, and make data-driven decisions to drive business growth and business functions.

Microsoft Dynamics SL

Microsoft Dynamics SL is an enterprise resource planning (ERP) solution that combines powerful project – and financial-management capabilities to help businesses manage customer demands, keep up with compliance regulations, and deliver services on time and on budget. Dynamics SL meets the unique needs of industries such as construction, government contracting and professional services and engineering projects.

Our Approach to ERP Implementation

There are many factors to consider when choosing ERP software. Let our experienced client strategists and certified ERP consultants help you find the right fit for your unique business.

Have you looked at the Total Cost of Ownership (TCO) of transitioning your ERP to the Cloud?

Is your company evaluating whether to transition your ERP solution to the cloud or stay on-premises? You’ll need to understand the economic impacts of your current ERP solution, and how it may look in the cloud.

Total Cost of Ownership is a financial estimate. It determines the economic value of an investment against your total costs over your system lifecycle. TCO estimates include six cost areas for companies transitioning to the cloud. Let’s dive into a comparative cost analysis between the cloud and on-premises.

Featured Blog Posts

What Makes LBMC Technology Solutions Different?

For over 20 years, LBMC Technology Solutions has been inspiring greatness through technology. We understand how important a reliable technology infrastructure is to your one-of-a-kind business. As your partner, we evaluate your unique business processes and current systems, then identify and apply the most effective solutions.

LBMC Technology Solutions is an award-winning reseller of recognizable industry standard software. If your business needs are beyond what an out-of-the-box software can offer, we will tailor a custom software solution to fit your specific business needs.

Our consultants build connections, nurture innovation, establish ongoing communication, and collaborate with you to architect the best system integration option to help you run your business better. We value our clients’ experience and have made it a critical part of our solutions to ensure we are earning your trust and becoming a long-term partner as your company grows.

Whether you need to supplement or outsource a single function, need an ally you can trust, or are in the market for a comprehensive business partner, LBMC Technology Solutions and our Family of Companies can simply be whatever your business needs us to be.